Top Guidelines Of Hard Money Atlanta

Wiki Article

Getting My Hard Money Atlanta To Work

Table of ContentsOur Hard Money Atlanta DiariesThe Definitive Guide to Hard Money AtlantaHard Money Atlanta Fundamentals ExplainedAn Unbiased View of Hard Money AtlantaThe Ultimate Guide To Hard Money AtlantaThe Single Strategy To Use For Hard Money Atlanta

A tough money finance is simply a temporary finance secured by property. They are moneyed by (or a fund of financiers) instead of conventional lenders such as financial institutions or cooperative credit union. The terms are normally around one year, yet the financing term can be reached longer terms of 2-5 years.The quantity the hard money loan providers are able to lend to the customer is mainly based upon the value of the subject building. The home may be one the borrower already possesses and also desires to make use of as security or it may be the home the consumer is acquiring. Hard money lending institutions are primarily interested in the instead of the customer's credit history (although credit is still of some value to the lender).

When the banks claim "No", the difficult cash lending institutions can still state "Yes". A customer can obtain a hard money lending on almost any type of type of property including single-family residential, multi-family property, business, land, and also industrial. Some difficult money lenders may concentrate on one certain building type such as household as well as not be able to do land loans, merely due to the fact that they have no experience in this location.

The 8-Second Trick For Hard Money Atlanta

Tough cash loans are ideal for situations such as: Land Loans Building And Construction Loans When the Purchaser has debt problems. When an investor requires to act quickly. Investor pick to utilize difficult money for lots of different reasons. The main factor is the ability of the tough cash lending institution to money the loan rapidly.

Contrast that to the 30 45 days it requires to obtain a small business loan moneyed (hard money atlanta). The application procedure for a tough cash funding typically takes a day or 2 as well as sometimes, a funding can be authorized the same day. Excellent good luck hearing back about a car loan approval from your financial institution within the exact same week! The capability to acquire funding at a much faster price than a financial institution finance is a considerable benefit for an investor.

Hard Money Atlanta Can Be Fun For Anyone

Hard cash lenders in California normally have reduced rates than other parts of the nation since California has several tough money providing firms. Increased competitors leads to a decrease in costs.As a result of this greater threat entailed on a difficult cash funding, the rates of interest for a hard money lending will certainly be greater than conventional finances. Rates of interest for tough money loans range from 10 15% depending upon the specific lender and the perceived threat of the car loan. Points can vary anywhere from 2 4% of the complete quantity lent.

The loan amount the difficult cash loan provider has the ability to provide is figured out by the ratio of the funding amount separated by the worth of a residential property. This is understood as the car loan to worth (LTV). Lots of tough money loan providers will certainly offer approximately 65 75% of the present value of the building.

Not known Details About Hard Money Atlanta

This produces a riskier financing from the hard money lending institution's perspective since the amount of funding placed in by the loan provider increases and the quantity of resources spent by the debtor reduces. This raised risk will certainly create a hard cash lender to charge a higher rate of interest - hard money atlanta. There are some hard money lenders that will offer a high portion of the ARV as well as will certainly also fund the rehab expenses.Anticipate 15 18% interest and also 5 6 factors website here when a loan Going Here provider funds a financing with little to no down repayment from the customer (hard money atlanta). In many cases, it may be rewarding for the debtor to pay these inflated rates in order to protect the offer if they can still produce benefit from the project.

They are much less concerned with the consumer's debt ranking. Concerns on a borrower's document such as a repossession or brief sale can be overlooked if the debtor has the funding to pay the interest on the financing. The difficult money lending institution should additionally think about the consumer's prepare for the building.

Unknown Facts About Hard Money Atlanta

An additional method to locate see page a hard money lending institution is by attending your regional actual estate financier club meeting. These club conferences exist in most cities and are normally well-attended by hard money lending institutions looking to network with prospective debtors. If no hard money lending institutions are present at the conference, ask other actual estate investors if they have a difficult money loan provider they can advise.

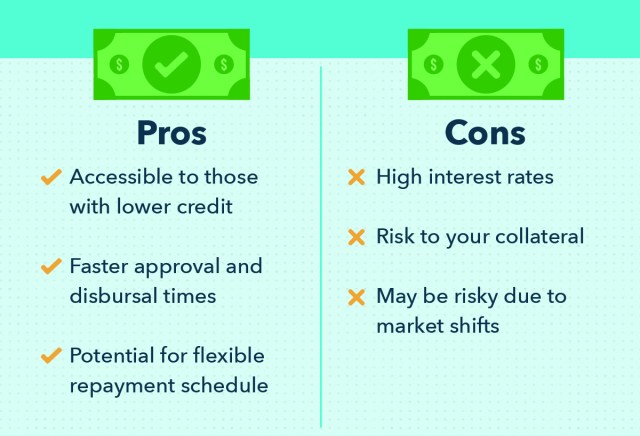

When you need moneying fast yet do not have the very best credit report, you can still obtain the funding you require supplied you get the ideal car loan. When it pertains to property, standard home loans are not your only alternative. You can additionally resort to so-called "difficult money financings." How do hard cash loans function? Is a tough cash loan ideal for your scenario? Today, we'll answer these questions, offering you the break down of tough money financings.

A Biased View of Hard Money Atlanta

With conventional car loan options, the lender, such as a financial institution or lending institution, will certainly look at your credit history and also validate your earnings to identify whether you can pay back the finance. On the other hand, with a difficult cash lending, you obtain cash from an exclusive lender or private, and also their choice to lend will certainly concentrate on the quality of the property.

Report this wiki page